In recent weeks, we’ve seen alarming news reports of Marketplace enrollees’ coverage being switched to a different plan without their knowledge. The story was first reported in early April 2024 by Julie Appleby, and CMS subsequently released a statement, acknowledging the problem and noting that the agency is “taking swift actions to protect consumers from unauthorized activity by agents and brokers.”

CMS has said that they received roughly 40,000 complaints about unauthorized plan switches in the first quarter of 2024, and roughly 50,000 complaints of unauthorized enrollments (meaning a new enrollment, as opposed to a plan change.

HealthCare.gov policyholders at risk

So what’s going on here? A lawsuit filed in April 2024 in U.S. District Court for the Southern District of Florida (Turner et al v. Enhance Health LLC et al) sheds some light on what’s been happening.

The lawsuit alleges that the problem started with lead-generating firms running fraudulent ads (see examples here) that “lure consumers with the false promise of hundreds of dollars per month in cash benefits, such as subsidy cash cards to pay for common expenses like rent, groceries and gas.” The alleged plan: to deliberately misrepresent the ACA’s advance premium tax credits – APTC – which are paid directly to an insurance company, not to the consumer.

According to the complaint, consumers who responded to these ads provided their personal information – and the defendants in the lawsuit purchased that information – allegedly knowing that “consumers are calling for the promise of cash benefits that do not exist.” The defendants were then able to use that data to access the consumers’ Marketplace accounts.

How was that possible? In states that use HealthCare.gov – the federally facilitated Marketplace (FFM) – agents and brokers only need an enrollee’s name, state, and date of birth to access the person’s Marketplace account. Those personal details were among the information that people provided when they responded to the fraudulent ads.

Scammers circumvent consumer protections

In 2023, CMS began requiring brokers to obtain documentation of consent from clients before enrolling them in an FFM plan. But according to one analysis these fraudulent operations have devised ways of getting around the consent requirement under the premise that clicking on a fraudulent ad is considered “consent.”

The complaint in Turner alleges the scheme was devised by several defendants – insurance brokerages – who then instructed their agents to use that information to access existing Marketplace accounts and switch the agent of record to themselves, thus stealing the actual agent’s commission. The lawsuit claims the defendants could also switch the enrollee to a different plan to generate a new or higher commission.

The damage to affected Marketplace buyers

It’s easy to see how this can be devastating for Marketplace enrollees who find out their health plan and/or broker has been switched without their knowledge or consent. For example, consumers may find that their new plan has higher out-of-pocket costs, a different provider network, or different covered prescription drugs.

The complaint in the Turner lawsuit also illustrates an example of a person who was enrolled in a Marketplace plan after trying to claim the cash mentioned in the ads. The entity enrolling the consumer deliberately underrepresented the buyer’s household income to maximize their subsidy amount (APTC). This meant the household had to repay that APTC to the IRS when they filed their tax return. (Here’s more about how APTC gets reconciled on a tax return.)

The lawsuit also includes an important point about the way enrollments are completed: It alleges that some of the defendants were utilizing two proprietary Enhanced Direct Enrollment (EDE) platforms, which allowed them “to enroll the maximum number of consumers in the shortest amount of time without outside scrutiny.”

To be clear, most agents and brokers enrolling people in FFM coverage are using a Direct Enrollment (DE) or EDE pathway rather than directly utilizing the HealthCare.gov platform. Eighty-one percent of all agent/broker-assisted active enrollments in the 2023 open enrollment period were completed via a DE or EDE pathway.

These entities are providing a valuable service, as the majority of legitimate agents and brokers are utilizing a DE or EDE pathway. But given the information in the lawsuit, it’s clear that the issue of unauthorized plan changes must be addressed on EDE platforms as well as the FFM platform.

Factors that led to the alleged fraudulent activity

Scammers are always evolving their approaches and looking for vulnerabilities they can exploit. And there are a few factors that have combined in the last few years to make this particular scam more profitable and easier to perpetrate.

First, the American Rescue Plan (ARP) enhanced Marketplace premium subsidies starting in mid-2021. For the first time, people with income up to 150% of the federal poverty level (FPL) do not have to pay any premiums to enroll in the benchmark Silver plan (second-lowest-cost Silver plan) or any plans priced below the benchmark plan. This is described in more detail below.

Second, a new special enrollment period (SEP) became available in March 2022 (optional for state-based Marketplaces), allowing subsidy-eligible applicants with household income up to 150% FPL to enroll in Marketplace coverage year-round. According to the lawsuit, “the year-round special enrollment period provided Defendants with the perfect opportunity to market and sell ACA plans to a market segment of low-income individuals that have may be in need for [sic] low-cost health insurance.”

And third, CMS issued guidance in June 2022, requiring health plans to ensure that agent/broker commissions were the same – regardless of whether the enrollment was submitted during the annual open enrollment period or during a special enrollment period (SEP). Before that, some insurers had reduced or eliminated commissions for SEP enrollments, but with the CMS guidance, that practice was no longer allowed.

Buyers with lower incomes targeted

According to one analysis, people most likely to be targeted for unauthorized plan switches are “mostly lower-income people, maybe working multiple part-time jobs.” It’s easy to see that the population most likely to be eligible for zero-premium plans – those with lower household incomes – might be the most common targets for the plan switches, as they can be enrolled into various plans without needing to pay any out-of-pocket premiums to effectuate their enrollment. (It’s easier to perpetrate this fraud if the victim isn’t paying a monthly premium, as they’re less likely to notice the problem and the ongoing enrollment doesn’t depend on them paying a monthly charge.) And due to the low-income SEP and the SEP commission rule, nefarious entities could conduct their fraudulent activity year-round.

Before 2021, enrollees with household incomes up to 150% FPL had to pay roughly 2% of their household income for the benchmark Silver plan. (The exact amount was adjusted each year.). The ARP reduced that to 0% for 2021 and 2022, and the Inflation Reduction Act extended that through 2025.

To be clear, some people had access to zero-premium plans even before 2021, if they selected a plan with a total premium that was less than the amount of their premium subsidy. But the number of people eligible for zero-premium plans increased significantly starting in 2021, due to the ARP’s adjustment to how subsidy amounts are calculated.

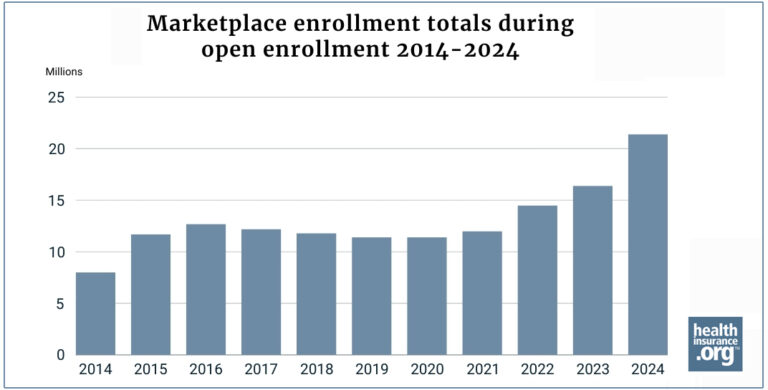

And the number of enrollees with income up to 150% FPL has grown significantly:

- During the open enrollment period for 2021 coverage (before the ARP was enacted), 12 million people enrolled in Marketplace coverage, and 3.8 million of them had household income between 100% and 150% FPL.

- During the open enrollment period for 2024 coverage, 21.4 million people enrolled in Marketplace coverage, and 9.4 million of them had household income between 100% and 150% FPL.

So while overall Marketplace enrollment has grown by 79% since 2021, enrollment among people with a household income up to 150% FPL has grown by 144%.

Is this happening in states that run their own Marketplaces?

At this point, the problem appears to be widespread only in FFM states,.

There are a few possible reasons for the problem being mostly isolated to the FFM, as opposed to state-based Marketplaces (SBMs). First, and probably most importantly, it’s easier for agents and brokers – including those with nefarious intentions but also those working to get clients enrolled in suitable coverage – to access enrollee accounts in the FFM versus SBMs.

Each state-based Marketplace has a different protocol, but it’s more common for them to have various forms of two-factor authentication that require the client to be actively involved for a new broker to access their account or make changes to their coverage.

And SBMs do not yet have EDE pathways for enrollment, so all SBM enrollment is completed via each state’s official SBM platform.

In addition, the pool of people who could be victims of this scam is smaller in SBM states, due in large part to Medicaid expansion. Medicaid expansion makes Medicaid available to adults with income up to 138% of FPL, meaning those people are not eligible for Marketplace subsidies. In states that haven’t expanded Medicaid, Marketplace subsidies are available to those with income as low as 100% of FPL. This means that a larger pool of low-income enrollees could potentially obtain Marketplace subsidies in states that haven’t expanded Medicaid.

Only ten states have not yet expanded Medicaid, and they all use the FFM. In a state that has not expanded Medicaid, Marketplace subsidies are available to enrollees with household income of at least 100% FPL, and premium-free benchmark Silver plans are available to those with household income up to 150% FPL. For a single adult enrolling in 2024 coverage, that means premium-free benchmark Silver plans are available in non-Medicaid expansion states within an income range of $14,580 to $21,870.

In states that have expanded Medicaid, including all of the states that use SBMs, Medicaid is available with a household income up to 138% FPL, and Marketplace subsidy eligibility starts above that level. So a single adult can qualify for a premium-free benchmark Silver plan with an income above $20,782 but not higher than $21,870 – a much smaller range than the one that applies in states that haven’t expanded Medicaid.

(Note: Medicaid eligibility is based on 2024 household income compared with the 2024 FPL guidelines; Marketplace subsidy eligibility is based on 2024 household income compared with the 2023 FPL guidelines.)

As noted above, 9.4 million people with household income between 100% and 150% FPL enrolled in Marketplace coverage during the open enrollment period for 2024 coverage. And 8.7 million of them were in states that use the FFM.

What should consumers do?

There are several things to keep in mind here. First, it’s important to understand that the ads promising cash or cash cards associated with Marketplace health insurance are misleading. Don’t click on these ads or provide any personal information, and let your friends and family know to be aware of this danger too.

Second, don’t ignore mail or emails from the Marketplace, your insurer, or your agent/broker. If you’re enrolled in a Marketplace plan, don’t mark email from the Marketplace or your insurer as spam, as you won’t see subsequent emails if you do. If in doubt as to the validity of an email you receive, it’s a good idea to call the entity in question (your broker, insurer, or Marketplace) to confirm that they sent the email and it wasn’t from an imposter organization.

If you receive a notification indicating that your broker or your plan has been changed and you didn’t authorize the change, reach out to the appropriate entities as quickly as possible. CMS advises consumers to contact the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325) “to report unauthorized activity associated with their Marketplace enrollment so the Marketplace can promptly resolve any coverage issues.”

Here’s information about how CMS and the FFM work to resolve the issue and get the person’s correct coverage reinstated. CMS has said that of the roughly 40,000 complaints about unauthorized plan switches they received in the first quarter of 2024, 97% have since been resolved. And of the roughly 50,000 complaints of unauthorized enrollments, 88% of the enrollments have been canceled during the resolution process. (Note that the number of complaints doesn’t necessarily reflect the full scope of the problem. It’s possible that some enrollees may not be aware that their plan was changed or that they were enrolled in coverage without their consent, or they may not have realized that they should file a complaint.)

If you have been working with a broker, reach out to them as well, so that they can assist with the process of getting any unauthorized changes reversed. And if you enrolled via an EDE, you should also reach out to the EDE to alert them about the fraudulent activity in your account.

You should also contact the Insurance Department in your state, which licenses and oversees agents and brokers authorized to conduct business in the state. CMS has noted that they are working to “root out bad actors who are violating CMS rules” and indeed, CMS can suspend an agent or broker’s Marketplace certification, and has noted that they are doing so in response to this issue. But the Insurance Department is the entity that can suspend or revoke an agent or broker’s license altogether, preventing them from selling insurance in any capacity within the state.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.