A major premise of the Affordable Care Act (ACA) was that Americans who need to buy their own health coverage in the individual market should be able to obtain coverage – regardless of their medical history – and that the monthly premiums should be affordable.

The rules to facilitate those goals have been in place for several years now. And although they have worked quite well for some Americans, there have been others for whom ACA-compliant health coverage was still unaffordable.

But the American Rescue Plan, enacted earlier this year, has boosted the ACA’s subsidies, making truly affordable coverage much more available than it used to be.

The numbers speak for themselves: Exchange enrollment has likely reached a record high of nearly 13 million people in 2021, after more than 2.5 million people enrolled during the COVID/American Rescue Plan enrollment window, which ended this month in most states.

How much are consumers saving on health insurance premiums?

And the amount that people are paying for their coverage and care is quite a bit lower than it was before the APR’s subsidy enhancements. We can see this across the states that use the federally run exchange (HealthCare.gov), as well as the states that run their own exchanges:

- Among the people who enrolled during the recent special enrollment period in the 36 states that use HealthCare.gov, average after-subsidy premiums were 27% lower than the amounts people were paying pre-ARP.

- Among HealthCare.gov enrollees who signed up during the special enrollment period or who updated their enrollments to claim the enhanced subsidies, 35% are now paying less than $10/month for their coverage.

- Average deductibles for new HealthCare.gov enrollees were 90% lower than pre-ARP deductibles, likely driven in large part by the number of people who were able to enroll in free or low-cost Silver plans with built-in cost-sharing reductions. (This includes people receiving unemployment compensation in 2021, as well as people who aren’t eligible for Medicaid and whose household income is between 100% and 150% of the federal poverty level.)

- The state-run exchange in Washington reported that 78% of their enrollees are now receiving premium subsidies, versus 61% before the ARP was implemented. And consumers with income above 400% of the poverty level, who were not eligible for subsidies pre-ARP, are now paying an average of $200 less in premiums each month. Washington’s exchange also noted that 15% of their enrollees are now paying $1/month or less for their coverage, versus only 5% whose premiums were that low pre-ARP.

- The state-run exchange in California reported that consumers with household incomes between 400% and 600% of the poverty level are saving an average of almost $800/month on their premiums. (That’s an individual with income up to about $76,000, or a household of four with an income up to about $157,000.)

- The state-run exchange in Nevada reported that people who enrolled or updated their account since the ARP was implemented are paying an average of $154/month in after-subsidy premiums, whereas the after after-subsidy premium at the end of last winter’s open enrollment period (pre-ARP) was $232/month.

- Maryland’s state-run exchange reported a 12% increase in the number of enrollees receiving subsidies; more than 80% of Maryland’s current exchange enrollees are subsidy-eligible.

These examples highlight the improved affordability that the ARP has brought to the health insurance marketplaces. People who were already eligible for subsidies are now eligible for larger subsidies. And many of the people who were previously ineligible for subsidies — but potentially facing very unaffordable health insurance premiums — are benefiting from the ARP’s elimination of the income cap for subsidy eligibility.

How long will the ARP’s subsidy boost last?

Although the ARP’s subsidies for people receiving unemployment compensation in 2021 are only available until the end of this year, the rest of the ARP’s premium subsidy enhancements will continue to be available throughout 2022 — and perhaps longer, if Congress extends them.

This means that the affordability gains we’ve seen this year will be available during the upcoming open enrollment period, when people are comparing their plan options for 2022.

Robust ACA-compliant coverage will continue to be a more realistic option for more people, reducing the need for alternative coverage options such as short-term plans, fixed indemnity plans, and health care sharing ministry plans.

Even catastrophic plans – which are ACA-compliant but not compatible with premium subsidies – are likely to see reduced enrollment over the next year, since more people are eligible for enhanced subsidies that make metal-level plans more affordable.

Can everyone find affordable health insurance now?

Unfortunately, not yet. There are still affordability challenges facing some Americans who need to obtain their own health coverage. That includes more than two million people caught in the “coverage gap” in 11 states that have refused to expand eligibility for Medicaid, as well as about 5 million people affected by the ACA’s “family glitch.”

There are strategies for avoiding the coverage gap if you’re in a state that hasn’t expanded Medicaid, and Congressional lawmakers are also considering the possibility of a federally-run health program to cover people in the coverage gap.

Families affected by the family glitch have access to an employer-sponsored plan that’s affordable for the employee but not for the whole family – and yet the family is also ineligible for subsidies in the marketplace/exchange. (It’s possible that the Biden administration could tackle this issue administratively in future rulemaking.)

Have ARP’s subsidy boosts been successful?

With the exception of those two obstacles, the ARP has succeeded in making affordable health coverage a more realistic option for most Americans who need to obtain their own health coverage. We can see success in the record-high exchange enrollment, the increased percentage of enrollees who are subsidy-eligible, and the reduction in after-subsidy premiums that people are paying.

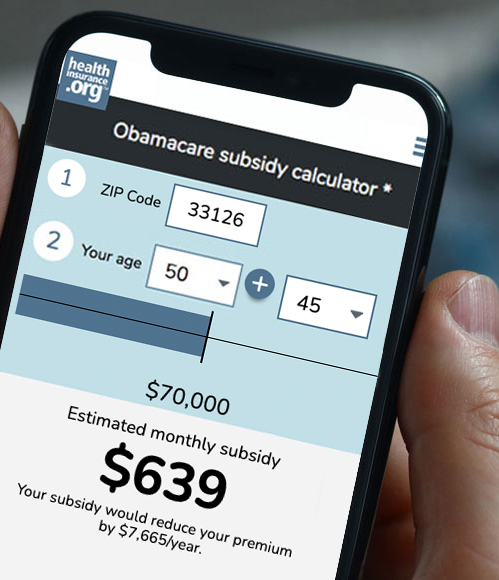

If you’re currently uninsured or covered by a non-ACA-compliant plan (including a grandfathered or grandmothered plan), it’s in your best interest to take a moment to see what your options are in the ACA-compliant market. Open enrollment for 2022 coverage starts in just two months, but you may also find that you can still enroll in a plan for the rest of 2021 if you live in a state where a COVID/American Rescue Plan enrollment window is ongoing, or if you’ve experienced a qualifying event recently (examples include loss of employer-sponsored insurance, marriage, or the birth or adoption of a child).

Even if you shopped just last winter, during open enrollment for 2021 plans, you might be surprised at the difference between the premiums you would have paid then and now. The ARP wasn’t yet in effect during the last open enrollment period, so if you weren’t eligible for a subsidy last time you looked, or if the plans still seemed too expensive even with a subsidy, you’ll want to check again this fall.

The subsidies for 2022 will continue to be larger and more widely available than they’ve been in the past, and you owe it to yourself to see what’s available in your area.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.