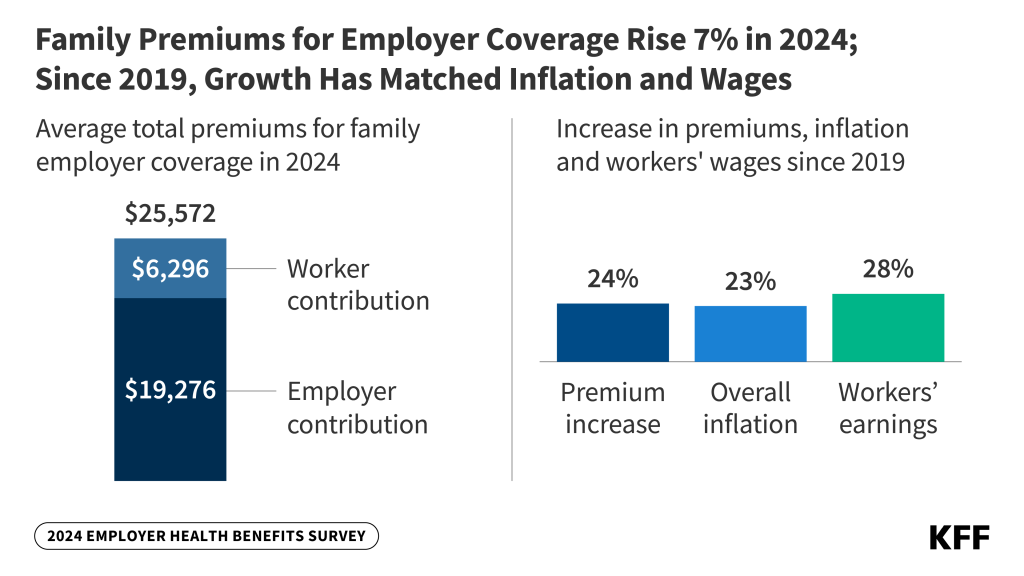

This year, family premiums for employer-sponsored health insurance increased by 7%, reaching an average of $25,572 per year, according to KFF’s 2024 benchmark Employer Health Survey. On average, employees contribute $6,296 annually towards family coverage costs.

This marks the second consecutive year of a 7% increase in premiums. Over the past five years, during a period characterized by significant inflation (23%) and wage growth (28%), cumulative premium growth has also been substantial (24%).

While the total premiums for family coverage continue to rise, the average amount workers pay towards their annual premiums has remained relatively stable over the past five years, increasing by less than $300 since 2019, which translates to a total rise of just 5%. This stability may reflect the pressures of a tight labor market.

For workers with an annual deductible for single coverage, the average this year is $1,787, which is comparable to last year’s $1,735 and shows a modest increase of 8% since 2019, when the average stood at $1,655.

Workers at small firms (with fewer than 200 employees) typically face higher deductibles than those at larger firms ($2,575 compared to $1,538). Among all covered employees, around one-third (32%) of those at smaller firms have an average single deductible of at least $3,000.

“Employers are spending an amount equivalent to purchasing an economy car for each worker every year for family coverage,” said KFF President and CEO Drew Altman. “In recent years, the tight labor market has made it difficult for them to pass on costs to workers who are already facing high healthcare expenses.”

Approximately 154 million non-elderly Americans depend on employer-sponsored health coverage, and the 26th annual survey, which included over 2,100 large and small employers, offers a comprehensive view of the trends influencing it. Alongside the full report and summary of findings released today, an article featuring selective findings will be published in Health Affairs, appearing in its November issue.

The survey reveals that many of the nation’s largest employers (with at least 5,000 employees) are implementing measures to protect lower-wage employees from the effects of escalating healthcare costs. Among these large firms, 29% report having a program to lower premiums for lower-wage employees, while 19% provide a reduced-benefit plan with more affordable coverage.

Employer Coverage of GLP-1 Drugs for Weight Loss is Limited and Restricted

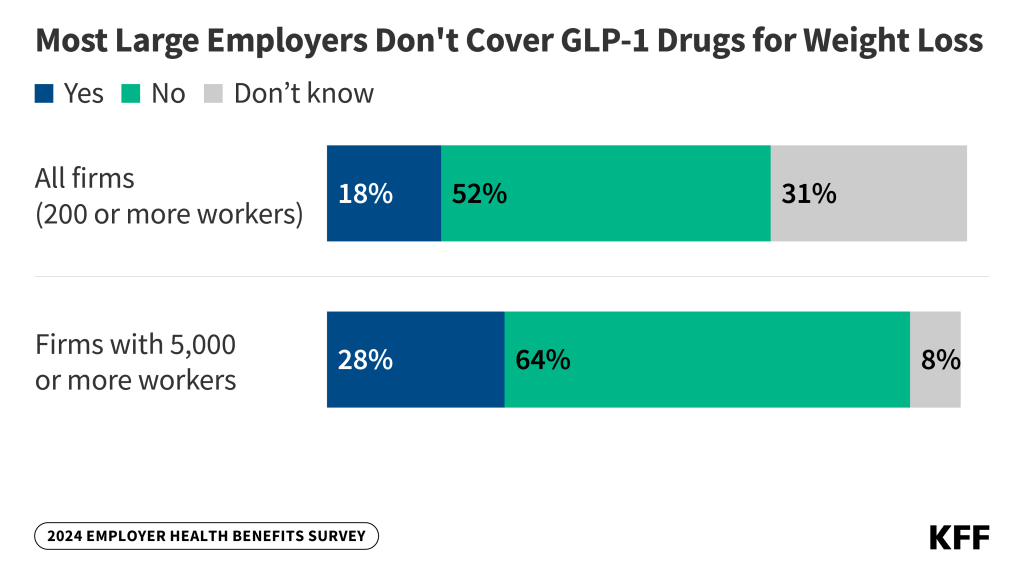

In light of the rising interest in expensive GLP-1 medications such as Wegovy for weight loss, this year’s survey examines the prevalence of such coverage in employer plans.

Fewer than one in five large employers with at least 200 employees offering health benefits (18%) report that they cover GLP-1 drugs for weight loss, while half (52%) state they do not provide coverage, and the remaining 31% are uncertain. Among the largest companies with at least 5,000 employees, more than a quarter (28%) cover GLP-1 drugs, and nearly two-thirds (64%) do not.

Among large companies that offer these medications, about half (53%) impose conditions or requirements for coverage. These requirements might include prerequisites like a consultation with a dietician, psychologist, or other professional (24%); requiring participation in a lifestyle or weight-loss program either before (8%) or during (10%) treatment; or other types of conditions (26%).

Providing coverage for these weight-loss medications carries significant cost implications for employers, as a previous KFF analysis estimated that nearly 50 million adults with employer health plans meet the clinical criteria for these treatments, which can incur thousands of dollars annually per individual.

Among large employers covering GLP-1 drugs for weight loss, one-third (33%) indicated that this coverage will have a “significant impact” on their plan’s prescription drug expenditures. Additionally, nearly half (44%) of all large firms believe that covering GLP-1 drugs will be “very important” or “important” for employee satisfaction with their health plan.

Among large companies that do not currently cover GLP-1 drugs for weight loss, only 3% say they are “very likely” to start doing so in the next year, while 23% indicate they are somewhat likely to do so.

“Employers are challenged by the need to integrate these potentially valuable treatments into their already expensive benefit plans,” stated KFF Vice President and study author Gary Claxton.

Other notable findings include:

- IVF and other family-building benefits. About 27% of large employers with at least 200 workers report covering in-vitro fertilization (IVF), with a similar percentage (26%) covering artificial insemination. A larger percentage (37%) cover fertility medications, while fewer (12%) cover egg or sperm freezing. Approximately one-third of employers are uncertain about whether their plans cover these services.

- Rebates from pharmacy benefit managers (PBMs). PBMs manage prescription drug benefits for payers, including employers, and often negotiate rebates with drug manufacturers for favorable formulary positioning. Among the largest firms with at least 5,000 employees, 34% claim they receive “most” of the rebates negotiated by their PBM or health plan, while another 34% receive “some,” and 8% report receiving “very little.” The remainder are unsure about their rebate amounts.

- Abortion. Among large employers with at least 200 workers, 8% report that their plan does not cover legally provided abortions under any circumstances. Additionally, 18% say they only cover such abortions under limited conditions such as rape, incest, or threats to the life or health of the pregnant individual. Most (45%) of other large employers are unsure about the extent of their abortion coverage. These figures have remained stable since 2023.

- Mental health and substance abuse. Approximately 25% of employers offering benefits say their plan’s network for mental health and substance abuse services is “somewhat” or “very” limited, compared to 10% who report the same for their general networks. About half (48%) of large firms with at least 200 employees have enhanced the mental health counseling resources available to their employees through employee assistance programs or third-party vendors like Headspace or Lyra Health.

- Spousal coverage and incentives for not enrolling. Among large firms with at least 200 employees that provide health benefits to spouses, 24% either charge higher premiums or place restrictions on coverage when spouses have health insurance from another source. Additionally, 12% of large firms offering benefits incentivize employees to enroll in a spouse’s plan, and 13% provide additional compensation or benefits to those who opt out of the company’s health plans.