In the United States, health care debt has become a widespread concern, catching the attention of lawmakers and emerging as a possible campaign topic. A 2022 KFF survey revealed that 2 out of 5 US adults (41%) across all age groups reported incurring some form of debt due to medical or dental expenses for themselves or others. Almost 75% of adults express concern over managing unexpected medical bills or healthcare costs, which is higher than those worried about other household expenses. The Medicare program provides health insurance to 66 million individuals, primarily older adults aged 65 and above, assisting with medical care costs for eligible individuals. However, many older adults still face health care cost issues, resulting in significant debt exposure with potentially serious and lasting repercussions for both health and finances.

Medicare covers a broad spectrum of health care services, including hospital stays, doctor visits, prescription medications, and post-acute care. However, beneficiaries typically face out-of-pocket expenses for premiums, deductibles, cost-sharing for Medicare-covered services, and expenses for non-covered services such as dental, vision, and hearing care and long-term services and supports. Households with Medicare beneficiaries generally spend more on health care compared to other households and allocate a higher percentage of their budgets to medical expenses. This is especially challenging for the millions of Medicare beneficiaries who have limited income and savings to cover unexpected health-related expenses. Additionally, older adults are more prone to cognitive impairments like Alzheimer’s Disease, which have been linked to declines in credit scores and financial instability years before diagnosis.

This data note explores findings from the KFF Health Care Debt Survey to evaluate the prevalence, sources, and repercussions of health care debt among adults aged 65 and older.

Key Takeaways

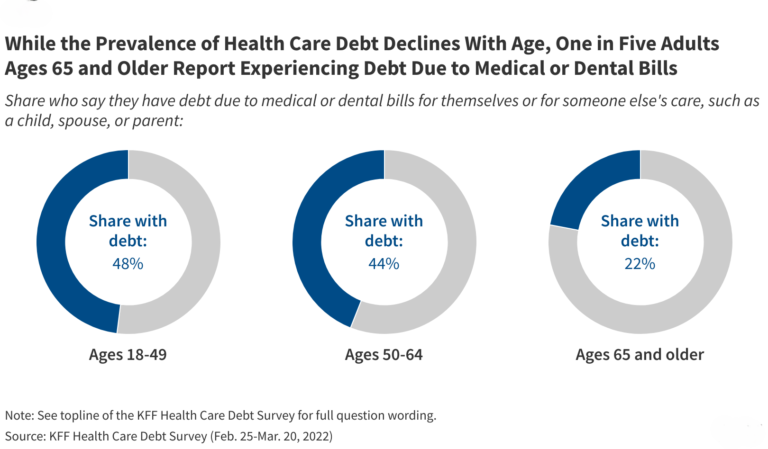

- In 2022, over one in five US adults aged 65 and above (22%) reported some form of debt due to medical or dental expenses, a figure that is half of what was reported among adults aged 50-64 (44%).

- Among Medicare-age adults facing health care debt, significant portions stated that some of the bills leading to their debt stemmed from routine health care services, including lab fees and diagnostic tests (49%), dental services (48%), and doctor visits (41%).

- Nearly 30% of Medicare-age adults with health care debt (29%) reported that their household had been contacted by a collection agency over medical or dental invoices in the last five years, while one-quarter (23%) noted that health care debt adversely impacted their credit score.

- Sixty-two percent of Medicare-age adults with health care debt indicated that they, or someone in their household, delayed, skipped, or sought alternatives to necessary health care or prescription medications due to costs in the past year.

In 2022, 22% of US adults aged 65 and older reported incurring health care debt due to medical or dental bills (Figure 1). This percentage is about half of that seen in adults aged 50 to 64 (44%), who have yet to qualify for Medicare based on age. The lower incidence of health care debt among older adults is likely attributed, in part, to nearly universal Medicare coverage for individuals aged 65 and over. Additionally, most Medicare beneficiaries possess some form of coverage that mitigates their cost-sharing exposure, like Medicare Advantage or supplemental coverage such as Medicaid, retiree health benefits, or Medigap.

The prevalence of health care debt among those aged 65 and older surpasses what has been reported elsewhere, primarily due to variances in the definitions and methodologies used to assess health care debt. Surveys have frequently concentrated on unpaid medical bills or those sent to collections, potentially overlooking individuals who finance their health care expenses through credit card debt, loans, or borrowing from family and friends. Therefore, the KFF Health Care Debt Survey offers a comprehensive perspective on health care debt, considering various types of debt incurred due to medical or dental expenses, as well as debts related to someone else’s care, such as that of a child, spouse, or parent.

Numerous older adults are managing their health care bills via credit card debt or other borrowing methods (Figure 2). Approximately 10% of Medicare-age adults report having medical or dental expenses they are paying down directly to a provider (12%), charged to a credit card and being paid off over time (11%), are overdue or unmanageable (8%), or carry debts owed to a financial institution or collection agency due to loans taken to settle medical expenses (7%). A smaller segment reported owing money to family or friends to cover medical or dental costs (3%).

About 39% of Medicare-age adults with health care debt owe less than $1,000, with 19% owing less than $500. Conversely, 11% of those with health care debt owe $10,000 or more (data not shown). Even smaller amounts of debt can adversely affect credit ratings.

Health care debt among older adults originates from various sources, including common health care services (Figure 3). Nearly half of Medicare-age adults with health care debt attribute some of their bills to lab fees and diagnostic exams (49%), dental care (48%), and doctor consultations (41%). One-third (31%) cite emergency services as a factor, and one-quarter (24%) relate it to prescription drug costs. Dental care is a leading contributor to health care debt among Medicare-age adults, probably because traditional Medicare does not encompass dental services. (While most Medicare Advantage plans provide some dental coverage, the extent of this coverage can vary significantly, and enrollees might still face considerable out-of-pocket expenses.)

Only 6% of Medicare-age adults attribute some of their debt to costs for long-term care services and support, such as nursing home care, assisted living, or round-the-clock in-home health aide services. While utilized extensively by a smaller portion of the Medicare population, these services can be extremely expensive. For instance, in 2023, the median annual cost for a private room in a nursing home was $116,800, while round-the-clock home health aide services cost $288,288. These costs significantly surpass the median income ($36,000 per individual) and savings ($103,800 per individual) of the average Medicare beneficiary in 2023. Medicare does not typically cover these services, rendering them financially inaccessible for many older adults and resulting in potentially significant debt. (Survey results may underrepresent the expenses and related debt incurred by individuals in nursing homes, assisted living centers, and similar institutional setups, although the survey does account for debt related to long-term services and supports incurred by other family members.)

The financial implications of health care debt can be long-lasting. Nearly 30% of Medicare-age adults with health care debt (29%) reported that their household has been contacted by a collection agency due to medical or dental bills, while one-quarter (23%) indicated that their credit score has suffered as a result of health care debt (Figure 4). For retirees facing health care debt, such consequences may be challenging to reverse, complicating the acquisition of affordable credit in the future. The Consumer Financial Protection Bureau recently suggested a regulatory change aimed at removing most health care bills from credit reports and preventing lenders from considering medical information in loan decisions, intending to alleviate the burden of health care debt for US adults and protect against coercive credit reporting issues.

Forty-two percent of Medicare-age adults with health care debt report that they or another household member have reduced spending on essential items (42%) or depleted a significant portion of their savings (39%) in the last five years due to their health care debt (Figure 5). One-third have withdrawn money from long-term savings accounts like retirement funds (34%) or increased their credit card debt for non-medical expenditures (31%), and one in five have borrowed money (21%) or delayed payment of other bills (18%). Such sacrifices can pose serious risks to financial stability and overall well-being, potentially perpetuating the cycle of health care debt by leaving older adults with fewer resources for necessary health-related expenses.

Sixty-two percent of Medicare-age adults with health care debt (62%) report that they or another household member have delayed, missed, or sought alternatives for necessary health care or prescription medications due to expenses (Figure 6). Nearly half (48%) of these adults postponed necessary medical care in the past year, two in five (43%) opted for home remedies or over-the-counter medicines instead of visiting a healthcare provider, and one-third advised against getting a recommended medical test or treatment (31%) or reduced their prescribed medication dosage by skipping doses, cutting pills, or not filling their prescriptions (28%).